Investing in an investment property can be one of the most lucrative and reliable ways to build long-term wealth.

Whether you are new to real estate investing or looking to expand your portfolio, understanding the key factors involved in purchasing and managing an investment property is essential.

In this site Decor.havenblueprint.com will guide you through the process of buying an investment property, highlight the best locations for 2024, discuss financing options, and explore tools that can help you make informed decisions.

What is an Investment Property?

An investment property is a real estate asset purchased with the intent to generate income through renting, leasing, or selling for a profit.

Unlike a primary residence, an investment property is acquired solely for the purpose of earning a return on investment (ROI).

These properties can include single-family homes, multi-family buildings, condos, commercial spaces, or vacation rentals. Investment properties can be a long-term or short-term financial strategy, depending on the investor’s goals.

Long-term investments, such as rental properties, generate steady income through monthly rent, while short-term investments, like house flipping, involve purchasing, renovating, and selling the property quickly for a profit.

Investors often seek to maximize ROI by choosing locations with high demand, appreciation potential, or development prospects.

Additionally, investment properties offer tax benefits, such as deductions for mortgage interest, property taxes, maintenance, and depreciation, making them an attractive option for building wealth over time.

However, they also come with risks, including market fluctuations and the costs of property management.

You can also read : Top Real Estate Investment Companies: Grow Your Portfolio Today

Benefits of Owning an Investment Property

Passive Income:

One of the main benefits of owning an investment property is generating passive income through rental payments. This can create a steady stream of cash flow, helping investors cover mortgage payments or reinvest in other properties.

One of the primary benefits of owning an investment property is the ability to generate passive income through rental payments.

This steady stream of cash flow helps investors cover mortgage payments, pay for property maintenance, or reinvest in additional properties.

Passive income from rental properties provides long-term financial stability and can significantly contribute to wealth-building over time.

Appreciation:

Real estate generally appreciates over time, meaning your investment property will likely increase in value, allowing you to sell it at a higher price in the future.

This long-term appreciation is often driven by various factors, including market demand, economic growth, and improvements in the surrounding area, such as new infrastructure or community developments.

Investors can also enhance property value through strategic renovations and upgrades, making the investment even more profitable.

Additionally, owning real estate can provide a hedge against inflation, as property values and rental income typically rise in tandem with inflation rates.

By understanding the dynamics of appreciation, real estate investors can make informed decisions and build a solid portfolio that not only generates passive income but also offers substantial returns over time.

Tax Benefits:

Investment property owners can take advantage of several tax benefits, including deductions for mortgage interest, property depreciation, repairs, and maintenance.

These tax deductions can significantly reduce taxable income, allowing property owners to retain more of their earnings.

Additionally, many investors can benefit from the 1031 exchange, a tax-deferment strategy that allows them to sell one investment property and reinvest the proceeds into another similar property without immediately incurring capital gains taxes.

This can enhance cash flow and accelerate wealth-building opportunities. Moreover, costs associated with property management and improvements can also be deducted, further increasing the potential for profit.

By understanding and leveraging these tax benefits, investment property owners can optimize their financial strategy and maximize the returns on their real estate investments.

Portfolio Diversification:

Adding real estate to your investment portfolio helps diversify your assets, reducing risk and enhancing long-term financial stability.

Portfolio diversification through real estate investment offers a valuable strategy for balancing risk and improving financial resilience.

Real estate assets generally have a low correlation with traditional investments like stocks and bonds, meaning they often perform differently under varying market conditions.

This reduces overall portfolio volatility, as real estate can provide steady income through rental yields and potential appreciation over time.

Additionally, real estate is often viewed as a hedge against inflation, as property values and rental income typically rise in line with inflation rates.

By including real estate, investors can achieve a more robust and balanced portfolio, enhancing their long-term financial stability.

You can also read : Property Investment for Beginners: Simple Steps to Get Started

Best Investment Property Locations in 2024

Austin, Texas

Austin continues to be a top destination for real estate investors due to its rapid population growth, strong job market, and increasing housing demand.

With a booming tech sector and a steady influx of new residents, Austin’s rental market remains hot, providing investors with consistent demand for rental properties.

Austin’s diverse economy and vibrant culture make it an attractive city for both residents and investors.

The city’s real estate market benefits from a growing number of tech startups, along with its reputation as a hub for music, arts, and outdoor activities.

As housing prices continue to rise, the demand for properties—particularly in up-and-coming neighborhoods—remains high, offering lucrative opportunities for investors looking to capitalize on long-term growth.

Benefits:

- High rental demand due to population and job growth

- Strong appreciation potential in residential and commercial properties

- Thriving rental market for both long-term and short-term leases

Cons:

- Rising property prices and competition

- Need for careful property management in a competitive market

Average Home Price: $550,000

Where to Invest: Explore opportunities on Realtor.com.

Raleigh, North Carolina

Raleigh’s real estate market is driven by its strong economy, particularly in the healthcare and tech industries.

The city’s affordable property prices and increasing demand for rental properties make it a prime location for buy-and-hold investors looking for long-term appreciation.

Benefits:

- Affordable property prices compared to other high-growth cities

- Strong rental demand due to population growth

- Attractive for investors seeking single-family homes or multi-family units

Cons:

- Slower growth in luxury real estate

- Property management costs may vary depending on the neighborhood

Average Home Price: $435,000

Where to Invest: Find properties on Roofstock.

Orlando, Florida

Orlando is a great market for investors seeking short-term rental income due to its booming tourism industry.

The city is home to major attractions like Disney World, which drives high demand for vacation rentals.

Additionally, Orlando has seen a steady increase in population, making it a solid choice for long-term rental investments.

Benefits:

- High demand for vacation rentals and short-term stays

- Population growth and strong rental demand

- Opportunities for appreciation in rental properties

Cons:

- High competition in the vacation rental market

- Local regulations may limit short-term rental durations

Average Home Price: $370,000

Where to Invest: Look for properties on Airbnb and VRBO.

You can also read : Top VRBO Owner Resources: Manage Vacation Rental

How to Finance an Investment Property

Financing an investment property is different from buying a primary residence. Lenders typically require higher down payments and interest rates for investment properties, as they are considered higher-risk loans. Here are some common financing options:

Conventional Loans

Conventional loans are one of the most popular financing options for investment properties, offering flexibility and competitive terms.

Typically, these loans require a down payment ranging from 15% to 25%, depending on factors like your credit score and the number of properties you already own.

With fixed or adjustable rates available, they are ideal for borrowers with strong credit looking to build their real estate portfolio.

Whether you’re exploring investment property loan options or comparing conventional mortgage rates, this financing choice provides a reliable path to property ownership

Interest rates for investment properties are usually higher than those for primary residences.

Benefits:

- Competitive interest rates for qualified buyers

- Available through most banks and mortgage lenders

Cons:

- Requires a higher down payment

- Stricter lending requirements

Hard Money Loans

Hard money loans are short-term, high-interest loans provided by private lenders or investors.

They are often used by investors looking to quickly purchase or renovate a property before selling it for a profit (fix-and-flip strategy).

Benefits:

- Fast approval process and access to funds

- Flexible lending requirements

Cons:

- High-interest rates and short repayment periods

- Not ideal for long-term investments

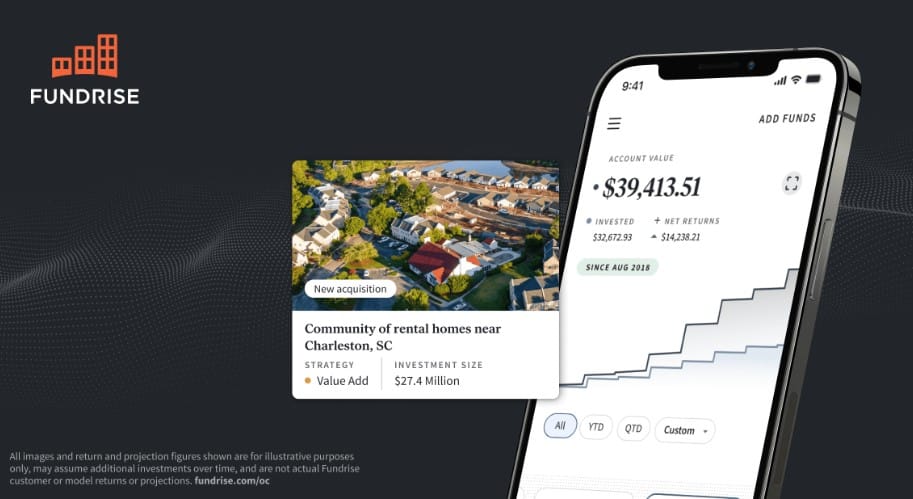

Real Estate Investment Platforms

For those looking to invest in real estate without purchasing a physical property, real estate investment platforms like Fundrise allow you to pool your money with other investors to fund large-scale real estate projects. These platforms offer lower entry costs and passive income opportunities.

Real estate investment platforms offer an accessible way to invest in real estate without the need to buy physical properties.

Whether you’re seeking crowd-funded real estate investments or passive real estate income, these platforms provide an easy entry into the world of property investment

Benefits:

- Low minimum investment

- Passive income through dividends

Cons:

- Less control over individual property investments

- Long-term investment with potential liquidity constraints

You can also read : Invest in Real Estate: Top Opportunities for Maximum Returns

Investment Property Management and ROI Tools

Managing an investment property can be time-consuming, but using property management tools and ROI calculators can simplify the process. Here are a few helpful tools:

Property Management Software

Platforms like Buildium or AppFolio help streamline the day-to-day management of rental properties.

They offer features like rent collection, tenant communication, and maintenance scheduling.

Benefits:

- Automates rent collection and tenant management

- Helps manage multiple properties efficiently

Cons:

- Subscription costs for advanced features

- Requires some initial setup and learning

Investment Property ROI Calculator

Using an ROI calculator is essential for analyzing the profitability of an investment property.

ROI (Return on Investment) calculators consider factors like rental income, operating expenses, and property appreciation to help investors estimate their potential returns.

Benefits:

- Provides a clear financial picture of property profitability

- Helps investors compare different property options

Cons:

- May not account for unexpected expenses or market changes

- Requires accurate data input for reliable results

Real-World Examples of Investment Properties

1. Turnkey Rental Property on Roofstock

Roofstock offers a selection of turnkey rental properties, which are already rented out and managed by professionals. These properties generate immediate cash flow, making them ideal for beginner investors.

Roofstock offers turnkey rental properties that come fully rented and professionally managed, making them a great choice for beginner investors.

These properties generate immediate cash flow without requiring hands-on management, providing an easy entry point into real estate investing.

Features:

- Fully rented out with property management in place

- Immediate rental income

- Detailed financial analysis available

Pros:

- No need to search for tenants

- Passive income from day one

Cons:

- Limited opportunity for customization or renovation

- Higher price due to turnkey convenience

Price: Varies by property

Where to Buy: Roofstock

2. Distressed Property on Auction.com

Auction.com is a platform where investors can purchase distressed properties at auction prices. These properties are often undervalued and ideal for fix-and-flip investors.

Features:

- Access to distressed properties at auction prices

- High potential for profit through renovation

Pros:

- Opportunity to purchase below market value

- Suitable for fix-and-flip strategy

Cons:

- Requires renovation and repair costs

- Higher risk if the property requires extensive work

Price: Varies by auction

Where to Buy: Auction.com

3. Fundrise eREIT Investment

Fundrise offers eREIT investments, which allow you to invest in real estate without purchasing physical properties. Investors pool funds to finance large-scale real estate projects and earn returns through dividends and property appreciation.

Features:

- Low minimum investment

- Diversified real estate portfolio

Pros:

- Passive income through quarterly dividends

- No need to manage physical properties

Cons:

- Limited control over specific property investments

- Long-term investment horizon

Price: Minimum investment starts at $500

Where to Buy: Fundrise

Common Investment Property Risks

While investing in an investment property can be highly profitable, it also carries certain risks:

- Market Volatility: Real estate markets can fluctuate due to economic conditions, leading to potential losses if property values decline.

- Property Management Costs: Managing rental properties requires time and money, especially if you’re dealing with maintenance, tenant issues, or vacancies.

- Financing Challenges: Securing financing for an investment property often requires a larger down payment and higher interest rates, which can impact cash flow.

How to Buy an Investment Property

- Research the Market: Begin by researching the best locations for investment properties in 2024. Look for areas with high rental demand, population growth, and appreciation potential.

- Secure Financing: Depending on your budget and financial goals, choose a financing option that works for you, such as conventional loans, hard money loans, or investing through real estate platforms.

- Analyze ROI: Use tools like ROI calculators to assess the potential profitability of the property. Consider rental income, operating expenses, and future appreciation.

- Work with a Real Estate Agent: A real estate agent who specializes in investment properties can help you find the right deals and navigate the buying process.

FAQs

Q: What is the best way to finance an investment property?

A: Conventional loans are the most common, but options like hard money loans or real estate platforms like Fundrise can also be effective, depending on your goals.

Q: How do I calculate ROI on an investment property?

A: Use an ROI calculator that factors in rental income, expenses, and property appreciation. Tools like BiggerPockets can help you get an accurate calculation.

Q: What are the best locations for investment properties in 2024?

A: Top locations include Austin, Raleigh, and Orlando, each offering strong rental demand and appreciation potential.

Investing in an investment property is an excellent way to build wealth, generate passive income, and benefit from tax advantages. With the right strategies, tools, and financing options, 2024 can be a great year to enter the real estate market.