Real Estate Investment Companies – When it comes to building wealth through real estate, choosing the right investment company can make all the difference.

Whether you’re a beginner or an experienced investor, the market is full of companies promising high returns and passive income opportunities.

In this article, Decor.havenblueprint.com will explore the best real estate investment companies in 2024, compare their services, and provide insights on how to choose the right firm for your needs.

What Are Real Estate Investment Companies?

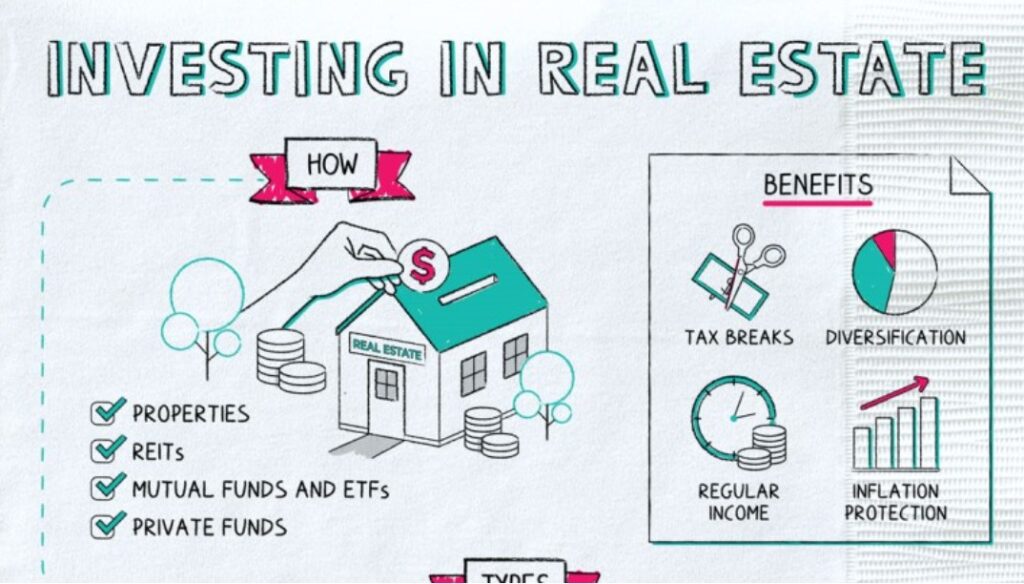

Real estate investment companies are firms that specialize in investing in properties, real estate funds, and other related assets.

These companies allow investors to pool their resources, gaining access to larger investment opportunities that might be difficult to attain individually.

Some firms offer direct ownership options, while others focus on real estate investment trusts (REITs), which allow you to own shares in real estate portfolios.

Real estate investment companies provide a way for individuals or institutional investors to participate in the real estate market without directly owning or managing properties.

These companies typically focus on acquiring, managing, developing, or financing real estate projects, such as residential, commercial, or industrial properties.

By pooling resources, investors can diversify their portfolios and access larger or more lucrative real estate ventures than they could achieve independently.

You can also read : Property Investment for Beginners: Simple Steps to Get Started

Benefits of Using Real Estate Investment Companies

Real estate investment companies provide several key benefits, including:

- Diversification: By investing in a range of properties, investors can spread risk across multiple assets.

- Passive Income: Many of these firms focus on generating income through rental properties, offering regular payouts to investors.

- Expertise: Real estate companies employ industry professionals to handle transactions, property management, and market analysis.

- High Returns: With the right company, investors can enjoy lucrative returns, especially in growing markets.

You can also read : Best Investment Property: Top Deals for Profitable Returns

Top Real Estate Investment Companies to Consider

Let’s dive into some of the leading real estate investment companies available today. These firms are known for their strong returns, ease of use, and excellent track records.

These companies are known for their ease of use, transparency, and ability to generate competitive returns, making them great choices for both new and seasoned investors.

Companies such as Roofstock, Fundrise, and RealtyMogul provide investors with access to residential and commercial properties, either through REITs (Real Estate Investment Trusts) or direct property ownership.

These platforms offer diverse investment opportunities, whether you’re looking to invest in rental properties, real estate debt, or equity, all with varying degrees of risk and return potential.

1. Fundrise

Fundrise is one of the most popular real estate investment platforms, especially for beginners. It offers an easy-to-use interface and a variety of investment options, including real estate investment trusts (REITs).

Fundrise is a leading real estate investment platform, particularly popular among beginners due to its user-friendly interface and accessible investment options.

The platform allows users to invest in a variety of real estate assets through real estate investment trusts (REITs) and other diversified portfolios, providing exposure to both commercial and residential properties.

With low minimum investments, Fundrise makes it easy for individuals to start building their real estate portfolio, offering the potential for long-term returns through income and asset appreciation.

The platform also provides transparency with detailed performance reports, making it a convenient and straightforward option for those looking to enter the real estate market.

- Pros:

- Low minimum investment

- Portfolio diversification

- User-friendly platform

- Cons:

- Limited liquidity

- Long-term investment horizon

- Price: Minimum investment starts at $10.

- Where to Buy: Visit Fundrise

Fundrise solves the problem of inaccessible real estate investing by lowering the barrier of entry with its low minimum requirements. It’s an excellent choice for those looking to begin their real estate investment journey.

2. CrowdStreet

CrowdStreet is a platform designed for accredited investors, offering access to larger commercial real estate investments.

Perfect for experienced investors looking to expand into commercial real estate with substantial returns.

CrowdStreet provides a streamlined platform for accredited investors to explore commercial real estate opportunities with the potential for high returns.

Specializing in larger, institutional-quality properties, CrowdStreet offers investors direct access to commercial real estate projects across various sectors.

Ideal for experienced investors seeking diversification, the platform combines transparency and robust data to support informed decision-making and long-term investment growth.

- Pros:

- High returns potential

- Access to high-quality deals

- Strong due diligence process

- Cons:

- Accredited investors only

- High minimum investment

- Price: Minimum investment starts at $25,000.

- Where to Buy: Visit CrowdStreet

3. Roofstock

Roofstock specializes in single-family rental properties. Investors can purchase rental homes and either manage them directly or work with a property management firm.

Roofstock is a leading platform that specializes in single-family rental properties, offering a streamlined process for real estate investors.

Through Roofstock, investors can purchase rental homes in various markets, allowing for diversification of their investment portfolio.

Buyers have the flexibility to manage the properties directly or partner with a property management firm, making it a convenient option for those seeking passive income.

With detailed property analysis, transparent pricing, and access to a wide range of investment opportunities, Roofstock empowers investors to make informed decisions and maximize their returns in the rental market.

- Pros:

- Direct ownership of property

- Full transparency on properties

- Passive income through rentals

- Cons:

- Requires more hands-on management

- Exposure to market risks

- Price: Costs vary based on the property chosen.

- Where to Buy: Visit Roofstock

Roofstock solves the problem of finding reliable, income-producing rental properties, making it a great option for those looking to earn passive income.

4. DiversyFund

DiversyFund is a real estate investment trust (REIT) that allows investors to pool money into commercial real estate assets, focusing on long-term growth.

This platform allows individuals to invest in high-quality real estate projects, typically reserved for institutional investors, making it an accessible option for those seeking to diversify their investment portfolios.

With a goal of providing consistent returns through income and property value appreciation, DiversyFund offers a unique opportunity for investors interested in the commercial real estate market.

By choosing DiversyFund, investors can participate in lucrative real estate opportunities with relatively low initial investment requirements.

- Pros:

- No management fees

- Long-term wealth-building focus

- Low barrier to entry

- Cons:

- Long investment timeline

- No dividend payouts until properties are sold

- Price: Minimum investment starts at $500.

- Where to Buy: Visit DiversyFund

DiversyFund’s focus on long-term growth makes it a solid option for investors seeking to grow wealth over time without the hassle of managing properties.

5. RealtyMogul

RealtyMogul offers both accredited and non-accredited investors access to various real estate investments, including REITs and individual properties.

Flexibility with both REITs and direct ownership, offering investors the opportunity to choose the right investment for their goals.

RealtyMogul offers a flexible investment platform for both accredited and non-accredited investors, providing access to a range of real estate opportunities, including REITs and individual properties.

Whether you’re interested in REIT investments or direct property ownership, RealtyMogul allows you to select the investment type that aligns with your financial goals.

This flexibility makes it a great option for those looking to diversify their portfolio and explore real estate as an investment vehicle.

For anyone seeking real estate crowdfunding platforms or investment opportunities in real estate, RealtyMogul offers an accessible and versatile solution.

- Pros:

- Access to both REITs and direct investments

- Strong track record

- Flexible options for different investor types

- Cons:

- High fees on certain investments

- Limited liquidity in some offerings

- Price: Minimum investment varies by project.

- Where to Buy: Visit RealtyMogul

You can also read : Top VRBO Owner Resources: Manage Vacation Rental

Comparing Top Real Estate Investment Companies

When comparing top real estate investment companies, it’s essential to evaluate several key factors, such as the company’s track record, investment options, fees, and customer support.

Look for companies with a proven history of profitable investments, diverse property portfolios, and transparency in their fee structures.

Whether you are a seasoned investor or just starting, choosing the right company can significantly impact your investment successWhen comparing these companies, consider the following factors:

- Accessibility: Companies like Fundrise and DiversyFund have low minimum investment amounts, making them ideal for beginners. CrowdStreet and Roofstock are better suited for more experienced investors with higher minimums.

- Investment Type: If you prefer REITs for a more hands-off approach, Fundrise and DiversyFund are great options. If you want direct ownership of properties, Roofstock and CrowdStreet are better suited.

- Returns: Higher returns typically come with higher risk. CrowdStreet has the potential for the highest returns but requires substantial investment.

- Liquidity: Many real estate investments are illiquid, meaning your money may be tied up for several years. Fundrise and RealtyMogul offer more flexibility.

You can also read : Invest in Real Estate: Top Opportunities for Maximum Returns

Benefits of Using Real Estate Investment Companies

Real estate investment companies offer several benefits, such as providing expertise in identifying profitable properties, handling the management of investments, and diversifying a portfolio.

These companies also mitigate risks, offer passive income opportunities, and provide professional advice to help investors navigate the market.

Their experience in property evaluation, renovation, and tenant management can lead to higher returns and a smoother investment process, especially for those new to real estate investing.

- Professional Management: These companies offer the expertise and resources needed to successfully manage real estate investments.

- Diversification: You can invest in a variety of properties and sectors without the burden of direct management.

- Consistent Returns: Real estate investments, especially through well-established companies, often provide consistent and passive income streams.

- Ease of Access: Many platforms offer easy-to-use websites and apps, allowing anyone to invest with just a few clicks.

FAQs

- What is the best real estate investment company for beginners?

Fundrise is an excellent option for beginners due to its low minimum investment and user-friendly platform. - Are real estate investment companies safe to invest in?

Yes, but like all investments, real estate carries some risk. Choosing a reputable company with a proven track record can help mitigate these risks. - Can I earn passive income through real estate investment companies?

Yes, many companies like Roofstock and Fundrise focus on generating passive income through rental properties or REITs.

This comprehensive guide outlines the best real estate investment companies available in 2024, helping you make an informed decision based on your financial goals and investment style.

Whether you’re a beginner or an experienced investor, these firms offer various opportunities to grow your wealth through real estate.